The Mortgage Rate Story: Today's Latest News & What It Signals for Tomorrow

Generated Title: Mortgage Rates in 2026: Buckle Up, Because the Ride Is About to Get Interesting

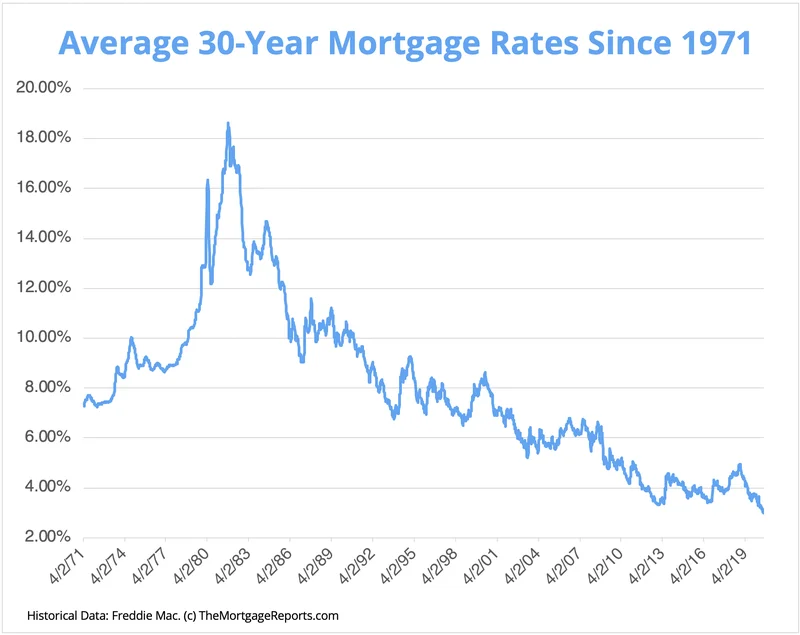

Mortgage rates. Ugh. I know, I know—hardly the most thrilling topic to kick off a blog post. But stick with me, because what's happening in the mortgage market right now, and what could happen in 2026, is a perfect example of how interconnected our world has become. It’s about economics, sure, but it's also about human psychology, global events, and even… well, we'll get to that.

The Big Idea? It's not just about predicting rates; it's about understanding the why behind the numbers, and how that understanding empowers you to make smarter decisions.

The Crystal Ball… or a Slightly Muddy Window?

So, what are the experts saying? The general consensus seems to be… well, it depends on who you ask! We're looking at three potential scenarios for 2026: rates could fall, stagnate, or even rise. Which, I know, sounds about as helpful as a weather forecast that says it might rain, snow, or be sunny. But let's break it down.

The first scenario, the one everyone's hoping for, is that rates fall. This hinges on inflation continuing to cool down, ideally hitting the Fed's 2% target. We saw inflation drop to 3% in September 2025, which is a huge improvement from the 9.1% peak we saw in June 2022. And, of course, the Fed cutting rates twice last fall was a welcome sign. If that trend continues, we could see some relief for homebuyers and those looking to refinance. Sarah DeFlorio, VP of Mortgage Banking at William Raveis Mortgage, put it well when she said everyone is optimistic that market conditions will continue to facilitate a rate-cutting cycle.

But what if inflation proves stickier than expected? What if it hovers just above that 2% target? Then we're looking at scenario number two: stagnation. Rates would likely stay roughly steady as the Federal Reserve aims for economic stability. Erik Schmitt, consumer direct channel executive at Chase Home Lending, noted that rates have generally stabilized, with only minimal movements rather than significant changes. It might not be the exciting drop we're all hoping for, but hey, stability isn't always a bad thing, right?

And then there's the third, slightly scary scenario: rates rise. This could happen if inflation spikes again, or if the labor market unexpectedly strengthens. Andrew Latham, director of content at SuperMoney, points out that if the economy continues to outperform expectations with strong consumer demand and job growth, markets may price in more risk. Nobody wants that, obviously, but it's a possibility we need to be aware of. For a deeper dive, here's "3 mortgage interest rate scenarios to know for 2026, according to experts".

Now, before you start hyperventilating, remember what I said earlier: it's not just about the numbers, it's about the why. It's about understanding the forces at play and being prepared for whatever comes our way.

Think of it like sailing. You can't control the wind (or the economy, for that matter), but you can adjust your sails to navigate the waters effectively. And one of the best ways to do that in the mortgage world is to lock in your rate. As Schmitt says, rate locks will remain important as we enter 2026 as the market and rates continue to fluctuate.

But here's where things get really interesting. Because all of these predictions, all of these scenarios, assume a certain level of… well, predictability. They assume that the rules of the game will stay the same. But what if they don't? What if something comes along and throws a wrench in the works?

I'm talking about… AI.

Yes, you heard me right. Artificial intelligence. I know, it sounds like I'm veering off into science fiction territory, but consider this: AI is already transforming every industry, from healthcare to transportation to… finance. What happens when AI starts making more accurate economic predictions? What happens when AI-powered tools can analyze market trends in real-time and advise borrowers on the optimal time to buy or refinance? What happens when AI can personalize loan products to an unprecedented degree, matching borrowers with the perfect mortgage for their individual needs?

It's not a question of if this will happen, but when.

And that's where the ethical consideration comes in. Because with great power comes great responsibility, right? We need to make sure that these AI-powered tools are used fairly and ethically, that they don't exacerbate existing inequalities, and that they empower everyone to achieve their financial goals.

So, What Does This All Mean for You?

The mortgage market of 2026 is a complex beast, no doubt. But it's also an opportunity. An opportunity to learn, to adapt, and to take control of your financial future. Keep an eye on the economic indicators, pay attention to what the experts are saying, and don't be afraid to explore new technologies like AI-powered mortgage tools.

The future is unwritten, and it's up to us to shape it.