Mortgage Rates Today: The Real Numbers on 30-Year, 15-Year & Refinance Rates

Generated Title: Mortgage Rates Dip? Don't Break Out the Champagne Yet.

A False Dawn for Homebuyers?

Mortgage rates have dipped slightly, according to recent reports. Freddie Mac says the average 30-year fixed rate is down three basis points to 6.23%. Zillow's data shows 6.04%. Optimal Blue clocks in at 6.169%. (The slight variations are due to differing data collection methodologies, naturally). Pending home sales are supposedly up, too, hinting at "resilience" in the market.

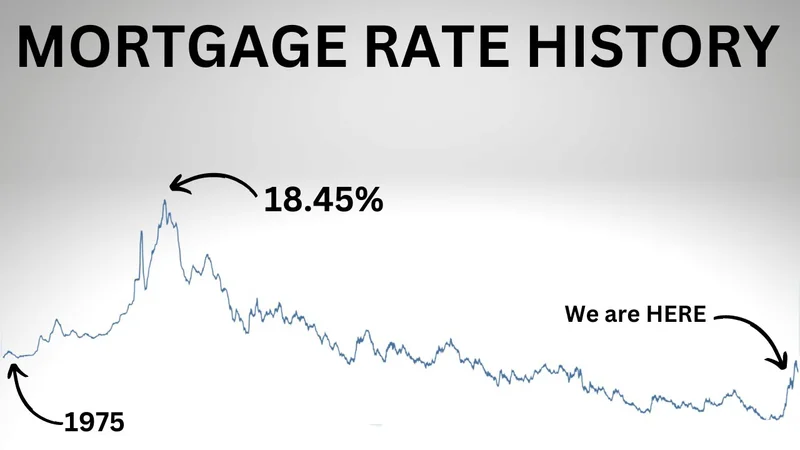

But let's pump the brakes on any celebratory spending, shall we? A few basis points are hardly a reason to pop bottles. We're still hovering around the 6% mark, a far cry from the pandemic-era lows that have warped everyone's sense of normalcy. Remember those days of sub-3% rates? Those were an anomaly, not the baseline.

And while a slight dip is technically good news, it's worth remembering that rates have been fluctuating wildly for months. One day they're down, the next they're back up, driven by the Fed's pronouncements and the market's jittery reaction to every economic indicator. As First American’s senior economist, Sam Williamson, notes, uncertainty surrounding the Fed's December meeting could result in "short-term volatility." In other words: buckle up. Mortgage and refinance interest rates today, November 26, 2025: 30-year rates dip as pending home sales rise

Parsing the Fine Print

The real story isn't just about the headline rate. It's about the spread between different types of mortgages. Take adjustable-rate mortgages (ARMs), for example. The conventional wisdom says ARMs offer lower introductory rates. Except, according to Zillow's data, fixed rates are currently lower. (Yes, I had to read that twice myself.) What does this tell us? The market is pricing in future rate increases, making fixed-rate mortgages a relatively safer bet, at least for now.

And this is the part of the report that I find genuinely puzzling. Why would anyone gamble on an ARM when fixed rates are already competitive? Are people still chasing the illusion of a lower payment, even with the risk of future rate hikes? The data suggests either a profound lack of financial literacy or a desperate gamble on a quick home flip. Neither scenario inspires confidence.

Speaking of gambles, let's talk about those "resilient" home sales. A closer look reveals that some buyers are resorting to desperate measures like negotiating rate buydowns with builders. Rate buydowns are essentially prepaid interest. It's like buying a discount on a future expense, and it's a clear sign that buyers are feeling the squeeze.

Here's where a methodological critique is warranted: How are these "pending home sales" being tracked? Are they adjusted for cancellations? Are they factoring in the increasing use of "creative" financing options that might not be sustainable in the long run? Without that context, the "resilience" narrative rings hollow.

The "Golden Handcuffs" Effect

One of the biggest factors impacting the housing market is the "golden handcuffs" effect. Millions of homeowners are locked into ultra-low mortgage rates from the pandemic era. Why would they sell and buy a new home at double the interest rate? Redfin data shows that 82.8% of homeowners with mortgages had rates below 6% as of Q3 2024.

This creates a supply shortage, which keeps prices artificially high. It's a self-perpetuating cycle of stagnation. People who want to move can't afford to, and people who need to move are reluctant to give up their sweet mortgage deals.

Time to Rethink the Narrative

The slight dip in mortgage rates is a blip, not a trend. The underlying dynamics of the housing market remain fundamentally unchanged. High prices, limited supply, and the "golden handcuffs" effect are still firmly in place. And while the Fed may cut rates again in December, as they did in September and October, history shows that mortgage rates don't always follow the Fed's lead in lockstep.

The market will continue to be volatile, sensitive to economic data and the Fed's pronouncements. Homebuyers hoping for a return to those pandemic-era rates are likely to be disappointed.

The Market's Still Rigged

Don't let the headlines fool you. A few basis points here and there don't change the fundamental reality: the housing market is still a tough nut to crack for most Americans.